Project Description

We Can Genuinely Teach Our Children — How America’s Colleges Could Be Tuition Free

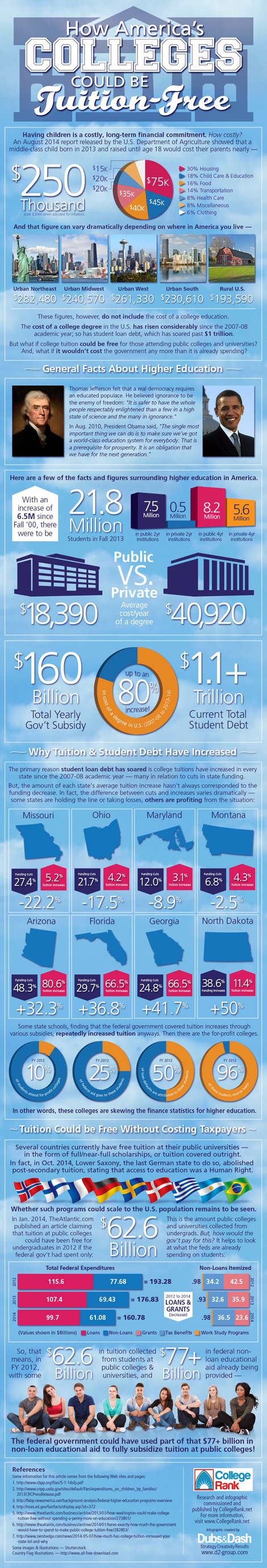

Source: CollegeRank.net

Tuition Free College

The child-rearing cost breakdown, using the $250K figure, is as follows:

- 30% housing = $75K

- 16% food = $40K

- 14% transportation = $35K

- 6% clothing = $15K

- 8% health care = $20K

- 18% child care and education = $45K

- 8% miscellaneous = $20K

- $282,480 for households in the Urban Northeast.

- $261,330 Urban West

- $240,570 Urban Midwest

- $230,610 Urban South

- $193,590 Rural

Whether parents or students or both bear the cost, the price of a college degree has gone up considerably since the 2007-2008 academic year in the United States. Student loan debt has also passed the trillion-dollar mark. Now, what if college tuition could be free — not for everyone, mind, but for students attending public colleges and universities? According to some accounts, the current higher education subsidies from the federal government are enough to support such an overhaul.

General Facts About Higher Education

- A degree opens up career paths.

- Simply to be educated and more informed.

Thomas Jefferson, 3rd President of the United States: “It is safer to have the whole people respectably enlightened than a few in a high state of science and the many in ignorance.” Jefferson felt that a real democracy requires an educated populace, who can better participate in the issues of the day. From nps.gov: “He believed ignorance to be the enemy of freedom, and he wanted to correct what he considered to be the defects of educational institutions modeled on European settings and curriculum.”

President Obama, our current and 44th president, had said in August 2010, at the University of Texas in Austin, “The single most important thing we can do is to make sure we’ve got a world-class education system for everybody. That is a prerequisite for prosperity. It is an obligation that we have for the next generation.”

Some of the “whys” are fairly established, so let’s focus on the facts and figures surrounding higher education in the United States.

- A record 21.8M students were expected for Fall 2013 in American colleges and universities, according to NCES (National Center for Education Statistics), a branch of the U.S. Dept of Education.

- This is an increase of 6.5M since Fall 2000. Approximate breakdown by school type:

- 7.5M in public 2-year institutions.

- 0.5M in private 2-year institutions.

- 8.2M in public 4-year institutions.

- 5.6Min private 4-year institutions.

- The national average cost of a degree, according to the Dept of Agriculture report, is $18,390/ year for a public college and $40,920/year for a private college.

- The cost of a college degree has increased in every state in the period 2007-08 to 2013-14 (academic years) — in some cases as much as 80%.

- Total student debt has exceeded $1.1 trillion (as of Mar 2014).

- Over $160B yearly (as of Fiscal year 2014) is the amount that federal government spends subsidizing higher education, albeit not necessarily in the most effective way that helps the maximum number of Americans.

- North Dakota increased funding by 38.6% and yet tuition still rose by 11.4% in that time period.

- Alaska increased funding by 3.5% but tuition rose by 18.4%.

- Georgia only reduced funding by 24.8% and Florida by 29.7%, and yet they had the second-highest tuition increases.

Why Tuition and Student Debt Has Increased Considerably

As to why these tuition increases happened in the first place, there is an approximate correspondence between the tuition increases and the reduction of state funding (44% on average since 1987) – though this is not the only reason. For example, the state of Arizona reduced overall funding for higher education in that FY 2008-2014 period by 48.3% — the highest percentage of all states. However, not every state’s tuition increases has a direct correspondence to budget cuts, so there are other more complex issues involved. For example:

Then there are the for-profit colleges. For FY 2011, about 10% of students were educated at for-profit colleges and received 25% of federal aid ($8.8B in Pell Grants), and account for 50% of student loan defaults (since about 96% of these students take out loans to pay the higher tuition costs that for-profit schools charge). In other words, these colleges are skewing the finance statistics for higher education.

As for other reasons for the increase in student debt, it’s been noted that there are many thousands of student loan fraud cases. Some people apply for excess student loans (beyond the amount of tuition, room and board) and either squander it away or never even attend college. Then are incidences of people who have lost their jobs who enroll for college so that they can apply for student loans — which they then use to pay for necessities such as rent and food. Some attend college; some do not. Free tuition would actually reduce incidences of such student loan fraud, if implemented in such a way that funds go directly to public institutions, either via a state government or directly from the federal government.

There is, of course more complexity to the increases in tuition, and it’s explained in great detail at ZeroHedge.com (see References section for an URL).

How Tuition Free College could be possible without Costing Taxpayers Extra — Maybe Less

The Atlantic.com published an article in Jan 2014 that claimed the federal government would only have to spend “a mere $62.6 billion dollars” to make tuition at public colleges free for undergraduates in 2012. This is the amount that public colleges and universities collected from undergraduate students. Of course, $62.6B is not “mere.” However, there’s more to the story, as per the data points, listed below. (Additional info from an older Atlantic.com article and newamerica.net; see References section for URLs.)

The federal government spent many billions on various student financial aid programs, including Pell Grants for low-income students, tax breaks, and work study funding. For example, $69.43B was spent in these three categories, total, in FY 2013. Loans are separate to this. The full breakdown for Federal Higher Education Student Aid, Fiscal Years (FY) 2012, 2013 and 2014 is as follows:

- Loans: $115.6B for FY 2012; $107.4B for FY 2013; $99.7B for FY 2014.

- Grants: $42.5B; $35.9B; $23.6B.

- Tax benefits: $34.2B; $32.6B; $36.5B.

- Work-study programs: $0.98B; $0.93B; $0.98B.

- Non-loan totals: $77.68B, $69.43B, $61.08B

- Total federal expenditures on education: $193.28 (FY 2012), $176.83 (FY 2013), $160.78 (FY 2014).

- About 75% of all undergrads are educated by public colleges and universities, yet a substantial amount of funding goes to private and for-profit schools — as much as 25% of federal aid dollars, at one point — including Pell Grant money.

However, $40.8B is still a lot of money. Wait, there’s more. The same writer wrote an earlier Atlantic.com article in Mar 2013 which claimed that “Washington (D.C.) could make college free” without spending more. The older analysis used the FY 2012 data as well, but using both grad and undergrad students at four-year and community colleges for the example.

- For FY 2012, nearly $60B in tuition was collected from grad and undergrad students at public colleges.

- As indicated earlier, $77.68B was spent on non-loan educational aid for FY 2012.

- Of the $42.5B in FY 2012 grants, $35B was for Pell Grants, most of which already goes to state schools (for FY 2011, 61% of Pell Grants).

Loans could still be awarded for those willing to take it on, to attend a more expensive for-profit or private institution. However, those attending public colleges and universities would only have to be concerned with various fees and room and board — and some institutions subsidize room and board.

Similar arguments on how to make tuition free have been made at ThinkProgress and by Robert Samuels at chronicle.com. Samuels is the President of the University Council – American Federation of Teachers, and the chronicle.com article is based on his book “Why Public Education Should Be Free” (Rutgers University Press, 2013). The article gives the example of the education achievements in Finland, due to making tuition free, as well as training teachers more thoroughly and paying them appropriately, amongst other factors. Samuels also points out that states still put in billions into education as well. So he hypothesizes that, were the resources (money) being spent on education at two levels of government used “in a more effective manner,” tuition for public institutions could essentially be free.

The Hurdles Towards a Free-Tuition Goal

If a plan for free tuition for public institutions goes, through, it might require a tiered tuition model from those schools, to prevent a mass exodus of students from wealthier families going to public universities. There are a lot of issues that need to be worked out, but at the least, future student debt would go down, and so too would incidences of college loan fraud. The initial savings under a free-tuition program could even be used to help recent graduates dispose of their student loan debt, under a variety of qualifications.

The only people that might not be happy under such a proposed free-tuition plan are long-time grads who had to pay off their loans the old-fashioned way (paying), and private and/or for-profit institutions of higher learning who would lose access to a variety of federal educational subsidies. As well, some students who could afford these more expensive schools due to federal aid will potentially be unhappy if they have to go to a public institution instead.

Until (if ever) such a “free tuition” plan gets approved for real, there are Web sites such as Coursera.org, where students can learn online for free, using content from top schools (over 90 as of the end of August 2014). While it’s not the same as getting a degree, some of the institutional partners offer a verified certificate for select courses through Coursera.

References

- http://www.cbpp.org/files/5-1-14sfp.pdf

- http://www.cnpp.usda.gov/sites/default/files/expenditures_on_children_by_families/2013CRCPressRelease.pdf

- http://febp.newamerica.net/background-analysis/federal-higher-education-programs-overview

- http://nces.ed.gov/fastfacts/display.asp?id=372

- http://www.theatlantic.com/business/archive/2013/03/how-washington-could-make-college-tuition-free-without-spending-a-penny-more-on-education/273801/

- http://www.theatlantic.com/business/archive/2014/01/heres-exactly-how-much-the-government-would-have-to-spend-to-make-public-college-tuition-free/282803/

- http://www.zerohedge.com/news/2014-05-07/how-much-has-college-tuition-increased-your-state-lot-and-why

This piece was reprinted by EmpathyEducates with permission or license. We thank College Rank for their expressed desire to teach and reach all of our children.