By Paul Buchheit | AlterNet. August 3, 2014

Any thinking person should be able to recognize the hardships of poor families.

The degree of ignorance about poverty is stunning, even for people far removed from the realities of an average American lifestyle. Both oilman Charles Koch and Nicole Miller CEO Bud Konheim have suggested that we should compare ourselves to poor people in China and India, and then just shut up and be happy. The Cato Institute informs Americans that “The current welfare system provides such a high level of benefits that it acts as a disincentive for work.” And entrepreneur Marc Andreessen explains, rather incomprehensibly, that “Technology innovation disproportionately helps the poor more than it helps the rich, as the poor spend more of their income on products.”

1. We Spend Relatively Little on Poverty Programs

Just two men made more investment income in 2013 than the entire year’s welfare budget (Temporary Assistance for Needy Families (TANF), commonly referred to as ‘welfare’).

Just 400 individuals made more investment income in 2013 than the entire safety net (SNAP, WIC (Women, Infants, Children), Child Nutrition, Earned Income Tax Credit, Supplemental Security Income, TANF, and Housing).

And the richest 1% made more from their investments in 2013 than the total cost of Social Security, Medicare, Medicaid, and the entire safety net.

2. $100 Shrank to $57 for the Median American Family: In Just 6 Years

A big part of it is debt. The total of mortgage, student loan, and credit card debt averages over $200,000 for American families. Stunningly, over a third of Americans have been reported to collection agencies because they couldn’t keep up with the bills.

3. Kids and Seniors Get the Worst of It

Almost two-thirds of all food stamp (SNAP) participants are children, elderly, or disabled.

Almost half of black children under the age of six were recently determined to be living in poverty.

Almost half of retirees are considered “economically vulnerable,” having less than $10,000 in savings in 2012.

A Day in the Life

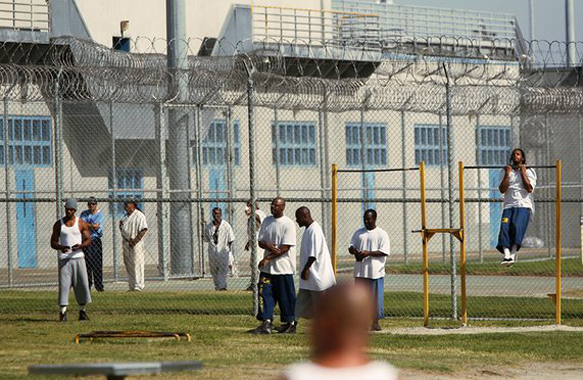

Any thinking person should be able to recognize the hardships suffered by poor families. They’re less likely to have health insurance, even though they’re probably living in a less healthy environment. If they own a home, there’s an estimated 40 percent chance that the outstanding mortgage is more than the value of the home. They’re less likely to have a car, even though having a car has been linked to greater success and opportunity. They’re three times more likely to be victimized by crime. They’re under constant financial stress, with nearly half of them lacking the assets to support their families for even three months.

Poor people have it easy? The real problem is that too many rich people have removed themselves from a society that they no longer care to understand.

Paul Buchheit is a college teacher, a writer for progressive publications, and the founder and developer of social justice and educational websites (UsAgainstGreed.org, PayUpNow.org, RappingHistory.org)

Leave A Comment