Oh, yes, there is praise for a plan and there are grand proclamations, but what we say and what we do…these are often in conflict. We speak of the need and the want to invest in higher education. We encourage our children to dream big and strive to be bigger. We tell them a college degree will bring you success, and then we question; is a degree all it is cracked up to be?

Daily we see the dichotomies. We hear the directives, “College graduation has never been more valuable than it is today.” We ponder the debate. Could it true, More College Does Not Beget More Economic Prosperity or is it that The Tuition is

How Washington Could Make College Tuition Free (Without Spending a Penny More on Education)

The federal government already spends enough on student aid to cover tuition for every public college student in America. Maybe it’s time to try.

It’s been a glum few weeks in the world of higher education. We officially learned that states kept slashing their funding for colleges and universities in 2012, and tuition in turn kept on rising. Student loan debt expanded over the year, and more borrowers are falling behind on their debt.

In other words, same as it ever was (same as it ever was). The price of a degree has been going up faster than family incomes for decades now, and nobody has a clear fix yet. So rather than bemoan college costs like most days, I thought we could have some fun mulling over a radical solution: What if Washington just went ahead and made tuition at state schools free (or close to it)?

It might be more doable than you think.

We Already Spend the Money

Here’s a little known fact: With what the federal government spent on its various and sundry student aid initiatives last year, it could have covered the tuition bill of every student at every public college in the country. Doing so might have required cutting off financial aid at Yale, Amherst, the University of Phoenix, and every other private university. But at this point, that might be a trade worth considering.

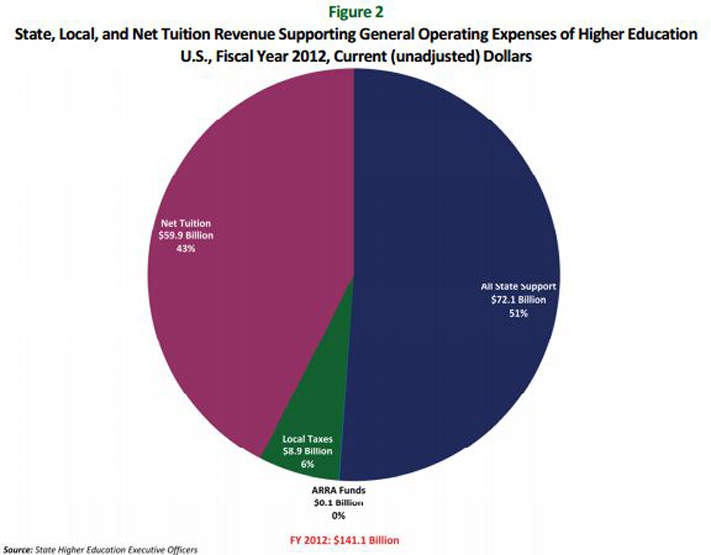

Let’s start with a quick survey of the numbers. Between graduate students and undergrads at both four-year and community colleges, students paid just under $60 billion in tuition to attend state institutions of higher learning in fiscal year 2012. That’s the giant magenta slice of the graph below, released this week by the State Higher Education Executive Officers Association. And just in case that figure sounds suspiciously low to you, the Department of Education reports that in the 2009-2010 school year, public colleges made about $57 billion off tuition (page 268, for those interested).

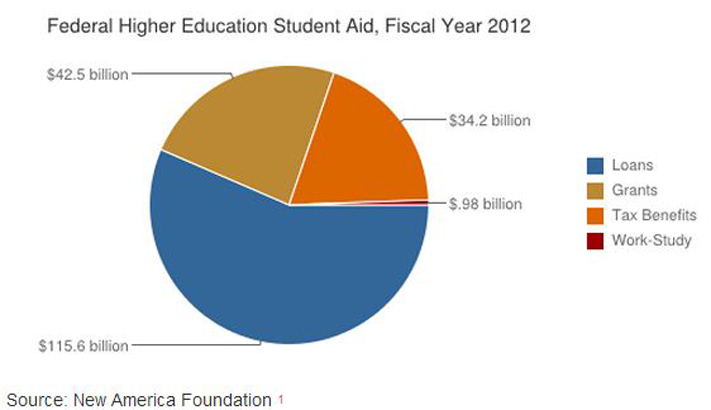

That’s our threshold: About $60 billion. Now how much does Washington spend on aid? According to the New America Foundation, the federal government appropriated some $77 billion worth of it in 2012 via a giant salad of tax breaks and grants, shown in yellow and orange below. The money we’d need for this grand experiment is already there.

To be sure, a good chunk of that funding already subsidizes state colleges. Take Pell Grants for low-income students, which currently cost Washington about $35 billion annually.* In the 2010-2011 school year, roughly 61 percent of that money, or $22 billion, went to students at public institutions.

But that doesn’t change the big picture: With the money that’s either going to private colleges, or being paid to the public sector in a roundabout way via tax breaks, we could probably make tuition at public institutions — which educate about 76 percent of American undergrads — either free, or ridiculously cheap. The question then becomes whether that’s a vision of higher education finance that we would want to embrace, and if it is, whether it would be a feasible policy.

What We’re Doing Now Is Crazy

Despite some of what you might have read, these problems haven’t actually turned college into a bad investment. Going and graduating is still probably the best financial decision anybody not named Gates, Jobs, or Zuckerberg can make in their lives. But the persistent rise in costs have made college a progressively worse deal with each passing year. Perhaps more importantly, it’s turned higher education into a much bigger financial gamble for marginal students at risk of dropping out — which, sadly, describes most young people who ever step foot in a college classroom.

The under-funding of public university systems and Washington’s attempts to compensate have also helped nourish a giant barnacle on the side of higher-ed: the for-profit college industry. As scarce classroom space at community and open-admission state colleges has filled up, students turned towards alternatives like Kaplan University and University of Phoenix, which charge tens of thousands of dollars for degrees with dubious job market value. They get away with it because of federal aid. I call it the 10, 25, 50 problem: They educate around ten percent of students, who receive about a quarter of federal student aid** and are responsible for about half of all loan defaults. They suck up about $8.8 billion, or around 25 percent, of all Pell Grant money.

And a “Public Option” Could Work

Turning our approach to aid inside out might be the right solution to these problems. Instead of handing money to students and parents, the federal government could instead send the cash down to the states, on the condition that local legislatures kept per student funding at a certain level, and colleges lowered their tuition rates (otherwise, it’s likely some states would just cut their support further while relying on Uncle Sam to prop up their schools, all while tuition kept rising). Since student enrollment is also projected to increase over time, the federal government’s contribution would probably have to be indexed in some way, either to inflation, or to the student population.

Now a confession: I went a bit overboard in the headline to get your attention. That’s because we probably wouldn’t want to make tuition entirely to free to all students, if only because that would risk triggering a crush of enrollment at open-admission schools, and probably encourage too many wealthier students to flood back into the public system, displacing needier kids. Instead, the goal would be to bring down the cost of school dramatically across the board, but while using progressive tuition levels so the poorest students paid nothing, while upper-middle-class and wealthy students paid a few thousand dollars each. That’s not far off from what many elite schools do now, who charge rich kids more so the poor kids pay less.

That approach might also help address one of the most serious potential objections to the idea of killing off our current aid system: that it could accidentally make school more expensive for some of the poorest families. The reality is that tuition is not the biggest expense for most full-time undergrads at public colleges: It’s < a target=new href=http://trends.collegeboard.org/college-pricing/figures-tables/average-published-undergraduate-charges-sector-2012-13>cost of living. After all the other aid low-income students receive, Pell Grants and tax breaks often end up paying for their meals and rent. But if colleges continued charging at least some tuition for wealthier students, the money could be cycled back into living expense grants for the neediest.

Done right, we would end up with what liberal policy wonk Mike Konczal has deemed a true “public option” for education that could help bring down costs in the private sector as well. Here’s how he explained the idea in Dissent a year ago:

Beyond ensuring equality of opportunity, another advantage of this approach is that it would help stop cost inflation. Free public universities would function like the proposed “public option” of healthcare reform. If increased demand for higher education is causing cost inflation, then spending money to reduce tuition at public universities will reduce tuition at private universities by causing them to hold down tuition to compete. This public option would reduce informational problems by creating a baseline of quality that new institutions have to compete with, allowing for a smoother transition to new competitors.

Yes, There Are Losers

Any major policy switch like this would create winners and losers, so let’s sort them out.

The biggest loser would be students at private colleges, including traditional nonprofits and the for-profits. They would suddenly see their access to Pell Grants cut off, along with their eligibility for tax breaks like the American Opportunity Tax Credit, which lets students or parents deduct up to $10,000 worth of tuition expenses over four years from their returns. The upshot of this is that fewer poor and lower-middle class kids would attend the Harvards and Stanfords of the world. That’s a big potential trade-off: About 15 percent of students at the 50 wealthiest colleges receive at least some Pell money. But there are reasons to think the impact wouldn’t be disastrous. Top colleges might simply increase their financial aid. And beyond that, those students would still have loans available. And going into a bit more debt for an elite education, and the professional network that comes with it, would probably still pay off.

With non-loan aid to their students cut off, traditional private colleges and for-profits would also be forced to reconsider their pricing.

Striving upper-middle-class families who want nothing more than to send their children to an Ivy League school would feel some of the pain as well. In 2009, families and students claimed $15 billion worth of tax breaks for tuition. About 26 percent of that money went to families earning $100,000 to $180,000 a year. Those deductions would be off the table.

Law students working in public service and art-history majors with $100,000 tuition bills would also lose out. Aside from the direct allowances for tuition, one of the larger tax breaks included in New America’s calculations is the student loan interest deduction, which lets single filers who make up to $75,000 a year chop up to $2,500 worth of interest off their annual taxes. This clearly helps borrowers with high debt loads. But again, the trade off would be that future generations would hopefully get to take out fewer loans in the first place.

Because that, again, would be the goal. By taking all the money that’s currently flooding into the private sector or going indirectly to schools via tax breaks and giving it to states with some conditions attached, we could bring down the actual prices students are paying today. Sure, some upper-middle-class kid in Pennsylvania might get less money to attend a private school like Villanova, but they might be able to go to Penn State for $4,000, instead of the $20,000 they’d pay today.

And There Are Philosophical Objections

There are a number of rational philosophical objections critics could also raise. You might say that:

- By bailing out public university systems, we’ll snuff out the exciting experiments in cost-saving educational technology that are just beginning to take seed. I’m not quite so concerned, since the private sector would still have plenty impetus to find creative ways of competing on cost with vastly less pricey state schools.

- More government meddling might lead to stagnation at some of our best public universities. But those schools seem to have worked well enough in the mid-20th century, when vastly more of their funding came from government.

- There might be less radical ways to fix our college costs problems, such as the Obama administration’s proposal to tie financial aid eligibility and accreditation to affordability. But without refunding public colleges, you risk either demanding they simply do too much with too few resources, or not demanding enough and simply enshrining the status quo.

- The benefits of college are great enough for individuals that we shouldn’t be in the business of subsidizing it all. But if that’s your stance, our policy argument is essentially metaphysical.

But It’s Worth Entertaining

Would making this massive switch be simple? God no. Just figuring out the minimum state contribution would be an enormous, politically tumultuous task. Would it be politically possible? Traditional colleges and the for-profit sector would battle against it tooth and nail. But our college cost disease is chronic enough that it’s worth at least entertaining an extraordinary cure.

After, it’s not as if the way we’re spending all that money now is working.

*They’re appropriated at $41 billion, so the effectively make up the entire grant’s portion of the pie chart.

Leave A Comment